Higher-beta Stocks Are Expected to Have Lower Required Returns.

Alpha is a measure of the difference between a portfolios actual returns and its expected performance given its level of risk as measured by beta. The equity portion is US large cap stocks while the bond portion is a ladder of treasury futures contracts and 10 is kept in short-term collateral that earns returns comparable to treasury bills.

Is Beta An Effective Measure Of Risk In Stock Selection Nasdaq

For example if a mutual fund returned 10 in a year in which the SP 500 rose only 5 that fund would have a higher alpha.

. Buying products with inverse returns is a relatively new method of hedging stocks. Selling a futures contract is a cheaper more efficient means of reducing equity exposure. Therefore the required rate of return I prefer using will most likely be different than yours simply because the return I require on the companies I purchase may be higher or lower than yours.

Enter the email address you signed up with and well email you a reset link. In other words my required rate of return will differ from yours because of the differences in our risk tolerance investment goals time horizon and available capital among. NTSX is essentially a 6040 exchange-traded fund leveraged at 15x to attain the 9060 designation.

This means that the stock has a negative correlation with the market. Buying products with inverse returns. Higher-beta stocks are expected to have higher required returns.

Selling and then repurchasing stocks can have an impact on the stock price while there is minimal market impact from trading futures. Conversely if the fund gained 10 in a year when the SP 500 rose 15 it would earn a lower alpha. Stock As beta is 10.

/dotdash_Final_What_Is_the_Best_Measure_of_Stock_Price_Volatility_Nov_2020-01-a8e356925bcb472194445af0b566336b.jpg)

What Is The Best Measure Of Stock Price Volatility

:max_bytes(150000):strip_icc()/BetaFinvizScreener-18bccb1de131439b826baa0193e877a1.jpg)

How Does Beta Measure A Stock S Market Risk

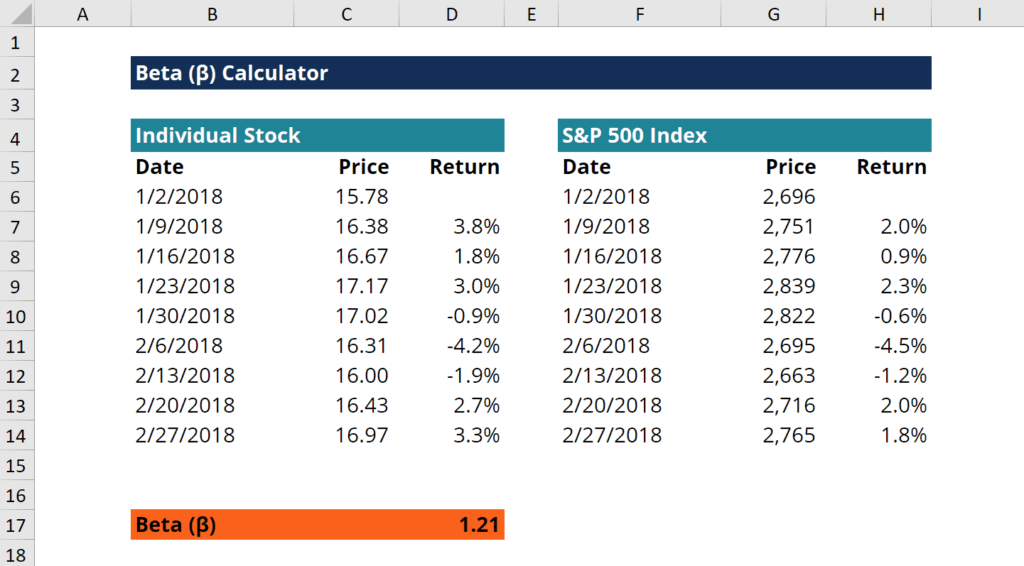

Beta What Is Beta B In Finance Guide And Examples

Difference Between Standard Deviation Risk Analysis Investing

No comments for "Higher-beta Stocks Are Expected to Have Lower Required Returns."

Post a Comment